Table of Contents

Introduction

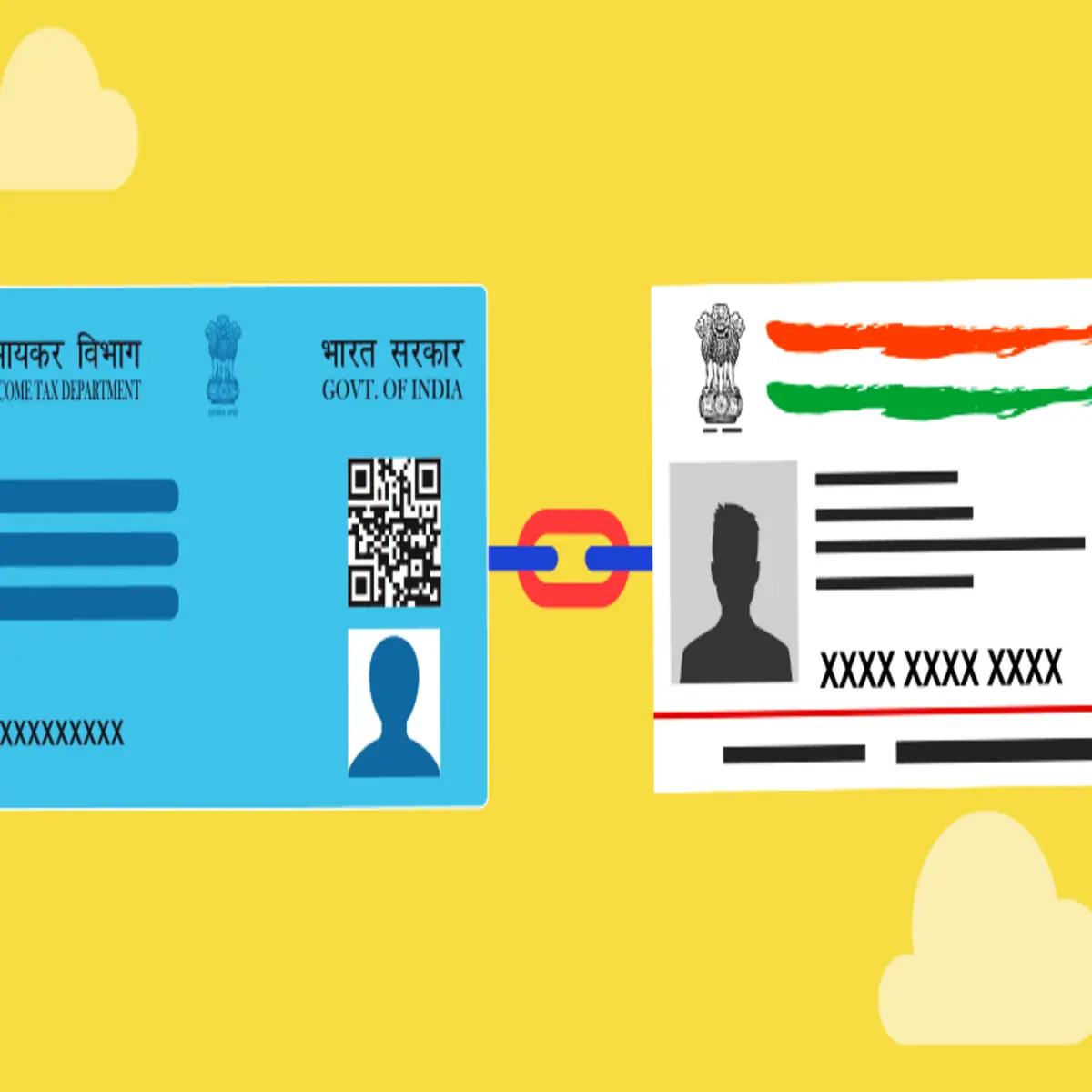

The Indian government took a significant step towards streamlining financial systems and curbing tax evasion by linking the Permanent Account Number (PAN) card to the Aadhaar card. This move aimed to enhance the accuracy and efficiency of tax-related processes and transactions. In this article, we will explore the advantages and significance of linking PAN Card to Aadhaar Card.

What is PAN Card?

The Permanent Account Number (PAN) card is a unique ten-digit alphanumeric identifier issued by the Income Tax Department of India. It serves as a crucial document for individuals and entities involved in financial transactions and taxable activities. PAN Card is required for various purposes, such as filing income tax returns, opening bank accounts, and conducting high-value transactions.

What is Aadhaar Card?

The Aadhaar Card is a biometric identification card issued by the Unique Identification Authority of India (UIDAI). It contains a twelve-digit unique identification number and serves as proof of identity and address for Indian residents. Aadhaar Card is linked to an individual’s biometric and demographic information, including fingerprints and iris scans, ensuring accurate identification.

The Linkage between PAN Card and Aadhaar Card

The Indian government recognized the potential benefits of linking PAN Card and Aadhaar Card, leading to the initiation of the PAN-Aadhaar linkage process. This process requires individuals to connect their PAN Card with their Aadhaar Card through an online verification process. Once the linkage is established, the PAN and Aadhaar numbers become interlinked and mutually valid.

Advantages of Linking PAN Card to Aadhaar Card

1. Simplified Tax Filing Process

The PAN-Aadhaar linkage simplifies the tax filing process for individuals. It enables direct and automatic retrieval of relevant information from the linked Aadhaar database, reducing the need for manual data entry. This integration streamlines the filing of income tax returns, making it more convenient and efficient for taxpayers.

2. Reduction in Tax Evasion and Black Money

The linkage of PAN Card and Aadhaar Card plays a crucial role in curbing tax evasion and combating the circulation of black money. By linking the two identification systems, the government can monitor financial transactions more effectively and identify discrepancies or potential tax evasion. This measure promotes transparency and fairness in the tax system.

3. Enhanced Efficiency and Accuracy

The integration of PAN and Aadhaar databases enhances the accuracy and efficiency of financial transactions and regulatory processes. It reduces the chances of errors and discrepancies in identifying individuals and their financial activities. With accurate identification, the government can ensure the proper allocation of resources and benefits.

4. Streamlined Financial Transactions

The PAN-Aadhaar linkage facilitates seamless financial transactions and enables individuals to complete various activities with ease. It eliminates the need for separate identification documents for different financial purposes. Individuals can use their Aadhaar-linked PAN Card as a single proof of identity and address for multiple transactions, such as opening bank accounts, applying for loans, or purchasing property.

5. Combating Identity Theft and Fraud

The PAN-Aadhaar linkage strengthens the security and authenticity of financial systems by reducing the chances of identity theft and fraud. With the integration of biometric data, such as fingerprints and iris scans, the government can ensure that individuals are uniquely identified, minimizing the risk of fraudulent activities.

Significance of PAN-Aadhaar Linkage for Individuals

For individuals, the PAN-Aadhaar linkage offers several significant advantages. It simplifies the tax filing process, eliminates the need for multiple identification documents, and ensures the accuracy of financial transactions. It also provides a secure and convenient means of accessing various financial services.

Significance of PAN-Aadhaar Linkage for the Government

The linkage of PAN Card to Aadhaar Card holds immense significance for the government. It strengthens the tax system, reduces tax evasion, and helps in the identification of unaccounted wealth. The integration of PAN and Aadhaar databases enhances the government’s ability to track financial activities, allocate resources effectively, and ensure transparency in financial transactions.

Concerns and Controversies

The PAN Card to Aadhaar Card linkage process has faced some concerns and controversies. Critics argue that it compromises privacy and data security, as it involves sharing sensitive personal information. Additionally, some individuals faced difficulties during the linking process due to technical glitches or mismatches in data. The government has taken measures to address these concerns and streamline the linkage process.

Conclusion

The linkage between PAN Card to Aadhaar Card brings numerous advantages to both individuals and the government. It simplifies tax filing, reduces tax evasion, enhances efficiency, and ensures accurate identification in financial transactions. While concerns and controversies exist, the government continues to refine the process to maximize the benefits while addressing privacy and data security concerns.

FAQs (Frequently Asked Questions)

- Why is it mandatory to link PAN Card with Aadhaar Card?

- The linkage of PAN Card with Aadhaar Card is mandatory to streamline financial systems, curb tax evasion, and enhance accuracy in tax-related processes.

- How can I link my PAN Card with Aadhaar Card?

- You can link your PAN Card with Aadhaar Card through an online verification process on the official Income Tax Department website.

- What happens if I fail to link PAN Card with Aadhaar Card?

- Failing to link PAN Card with Aadhaar Card may result in the invalidation of your PAN Card, rendering it unusable for various financial transactions.

- Is the linkage of PAN and Aadhaar applicable for non-resident Indians (NRIs)?

- Yes, NRIs are also required to link their PAN Card with Aadhaar Card if they have both documents.

- Can I use my Aadhaar Card as a substitute for PAN Card?

- No, the Aadhaar Card cannot entirely substitute the PAN Card. However, linking both cards enables seamless financial transactions and simplifies the identification process.

GET MORE INFO-30 June Digital Revolution: Celebrating Social Media Day with a Global Community!